Learn how to make smart, confident, and cost-effective home-buying decisions in your area.

Buying a home is one of the biggest financial decisions you’ll ever make—and with so many options for homes for sale near you, it’s easy to feel overwhelmed. Whether you’re working with an agent or exploring FSBO (For Sale by Owner) listings, avoiding common pitfalls can save you thousands and help you find the perfect property with confidence.

In this guide, we’ll cover the five most frequent mistakes buyers make when purchasing a home near them—and how to avoid them—so you can move forward informed and stress-free.

Mistake #1: Not Defining Your Budget Early

Before browsing homes or attending open houses, take time to understand your true purchasing power.

Many buyers start their search by looking at listings “just to get a feel,” but this often leads to frustration when they find a dream home outside their budget.

How to Avoid It

- Get pre-approved for a mortgage before you start viewing properties.

- Factor in hidden costs such as taxes, maintenance, HOA fees, insurance, and closing expenses.

- Use an online mortgage or affordability calculator to set realistic expectations.

Pro Tip: Aim for a monthly payment that doesn’t exceed 30% of your gross income. It ensures long-term affordability and financial stability.

Mistake #2: Overlooking Local Market Trends

Many buyers focus solely on the house itself but ignore local real estate market conditions. Prices, supply, and demand vary greatly from one neighborhood to another—and buying at the wrong time or place can cost you equity.How to Avoid It

- Research home prices near you over the past 12–24 months.

- Compare FSBO homes and agent-listed properties to gauge true value.

- Check local amenities, school ratings, commute options, and planned developments.

Pro Tip: A home’s location influences not just your lifestyle—but its long-term resale value.

Mistake #3: Skipping Home Inspections

Even in competitive markets, never skip a home inspection. Hidden issues like roof leaks, plumbing defects, or electrical faults can turn your dream home into a costly nightmare.

How to Avoid It

- Hire a certified home inspector—not just a contractor.

- Attend the inspection personally and ask questions.

- Use the findings to negotiate repairs or lower the price before closing.

Did you know?

According to the American Society of Home Inspectors, nearly 20% of buyers who skip inspections face major repair costs within the first year.

Mistake #4: Ignoring FSBO Opportunities

Many buyers focus exclusively on agent listings and overlook FSBO homes near them—properties sold directly by the homeowner. These can be hidden gems offering better pricing and faster negotiations.

How to Avoid It

- Search dedicated FSBO websites and local directories like houses-for-sale-near-me.net.

- Communicate directly with homeowners to ask about price flexibility and included furnishings.

- Still hire a real estate attorney or title company to handle legal documentation.

Pro Tip: FSBO transactions often move faster and can save both sides 5–6% in commission fees—if both parties are prepared.

Mistake #5: Rushing the Process

Buying a home is emotional, but acting too quickly can lead to regret. Whether pressured by a “hot market” or fear of missing out, skipping due diligence is a major mistake.

How to Avoid It

- Visit multiple homes before making an offer.

- Research comparable sales (comps) to confirm fair pricing.

- Don’t waive contingencies (inspection, financing, or appraisal) unless you fully understand the risks.

Reminder: Your home is a long-term investment. Take the time to get it right—the right property will always be worth waiting for.

Final Thoughts

- Buying a home—especially one near you or directly from the owner—can be both exciting and financially rewarding when done strategically.

- By avoiding these five common mistakes, you’ll make smarter decisions, minimize risk, and secure a property that meets both your lifestyle and financial goals.

Whether browsing FSBO listings, local agent properties, or new developments, always stay informed, compare options, and seek professional advice when needed.

5 Common Mistakes to Avoid When Buying a Home Near You

5 Common Mistakes to Avoid When Buying a Home Near You  Buying and Selling Property Directly — The Pros, Cons & Real Advantages

Buying and Selling Property Directly — The Pros, Cons & Real Advantages  Real Estate FAQs – Your Ultimate Guide to Buying, Selling & Renting Homes

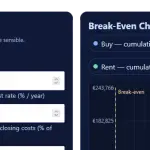

Real Estate FAQs – Your Ultimate Guide to Buying, Selling & Renting Homes  Free Rent vs Buy Calculator

Free Rent vs Buy Calculator  Owner Financing: Definition, Example, Advantages, and Risks

Owner Financing: Definition, Example, Advantages, and Risks